Archive

Artmarket.com : Artprice et Cision étendent leur alliance sur 119 pays, comme 1ère agence de presse mondiale dédiée au Marché de l’Art, aux NFTs et aux Métavers

(23 Nov. 2021) – Artprice by Artmarket, dont l’actionnaire de référence est le Groupe Serveur ®, pionnier de l’Internet depuis 1985 en Europe, et Cision® (PR Newswire) sont heureux d’annoncer l’extension de leur alliance unique au monde à 119 pays, pour la distribution de fils d’informations.

Artprice Metaverse

© ‘Alchemical Fractal 2’ (collection of 999 works), raw steel, NFT sculpture and algorithm by thierry Ehrmann.

Courtesy of Organe Museum / Abode of Chaos / La Demeure du Chaos

© ‘Alchemical Fractal 2’ (collection of 999 works), raw steel, NFT sculpture and algorithm by thierry Ehrmann.

Courtesy of Organe Museum / Abode of Chaos / La Demeure du Chaos

artprice-nft.com

Ce partenariat, désormais étendu, confirme Cision comme le distributeur officiel d’informations et de contenus pour le Leader mondial de l’information sur le Marché de l’Art qu’est Artprice by Artmarket.

Selon Frédéric Dumas, Vice-Président Sales de Cision France : « Cision accompagne les marques mondiales respectées dans le monde entier. Poursuivre et renforcer le partenariat avec Artmarket.com donne à Cision la possibilité d’être à la pointe de l’actualité du Marché de l’Art, de la blockchain, de l’univers des NFTs et du métavers. »

Pour thierry Ehrmann, Fondateur d’Artprice et Président d’Artmarket.com : « Cette alliance déployée sur 119 pays nous permet avec Cision d’atteindre les pays émergents de tous les continents, qui ont déjà une avance considérable sur l’Occident concernant la crypto, la Blockchain et les NFTs. Cette alliance stratégique repose sur 21 ans de confiance et de pratique quotidienne entre Cision PR Newswire et Artprice by Artmarket. »

Depuis 120 ans, Cision a bâti peu à peu un réseau mondial de diffusion d’informations, reconnu par plus de 100 000 clients notoirement connus sur les marchés financiers. Cision est le Leader mondial du logiciel de RP & Influence.

Avec sa base de données de 1,6 million de journalistes et de médias, Cision diffuse une information qualitative sur l’ensemble des 5 continents.

L’accord est le résultat direct d’une longue relation de confiance qui s’étend depuis plus de deux décennies entre Artprice et Cision, deux leaders puissants sur leurs marchés respectifs.

thierry Ehrmann : «Le fil de presse de Cision dépasse la norme de l’industrie en matière de diffusion d’informations. Il permet à Artprice d’atteindre un plus large public, qui représente désormais, par les NFTs, autour des artistes, environ 900 millions d’Art lovers, collectionneurs, professionnels du Marché de l’Art, notamment les galeries, Maisons de Ventes et institutionnels dans le monde entier, profondément rajeunis par le NFT, ses nouveaux territoires et Metaverse.

Ce fil étendu d’informations quotidiennes atteint les profondeurs des 119 pays, tant en Occident que dans les pays émergents, à la pointe des NFTs, portés par des communautés d’artistes qui changent le monde dans un nouveau paradigme où l’artiste est désormais le principal acteur au cœur du Marché de l’Art. Il est dans la continuité de notre Manifeste. »

Artprice a déjà une communauté ouverte de 765 000 artistes et de 5,4 millions de membres impliqués et contributifs, dont 4,5 millions de collectionneurs et Art lovers ainsi que 900 000 professionnels de l’Art.

Par cette alliance avec Cision étendue sur 119 pays, Artprice by Artmarket va à la rencontre des nouveaux mondes et de leurs univers parallèles.

#ArtMarket by #ARTPRICE $PRC $ARTF #NFT #CryptoArt #metaverse #DigitalArt #NFTs #MarketPlace #BTC #ETH #OpenSeaNFT #raribleNFT #Ethereum

Images :

[https://imgpublic.artprice.com/img/wp/sites/11/2021/11/image1-artprice-metaverse-thierry-ehrmann-organ-museum-002.jpeg]

[https://imgpublic.artprice.com/img/wp/sites/11/2021/11/image2-artprice-NFT-bill.jpg]

À propos de Cision / PR Newswire :

Cision, éclaireur de marques, est le leader mondial des logiciels de Earned Media, RP & Influence destinés aux professionnels de la communication. Cision permet aux communicants d’identifier et de s’engager auprès de leurs journalistes et influenceurs clés, d’élaborer et de diffuser du contenu, et de mesurer l’impact de leurs campagnes : TV, Radio, Presse, Web et Réseaux Sociaux. Cision compte plus de 4 000 employés et possède des bureaux dans 22 pays différents (Amériques, EMEA, APAC).

Copyright 1987-2021 thierry Ehrmann www.artprice.com – www.artmarket.com

Le département d’économétrie d’Artprice répond à toutes vos questions relatives aux statistiques et analyses personnalisées : econometrics@artprice.com

En savoir plus sur nos services avec l’artiste en démonstration gratuite :

https://fr.artprice.com/demo

Nos services :

https://fr.artprice.com/subscription

Artmarket.com: Artprice and Cision extend their alliance to 119 countries to become the world’s leading press agency dedicated to the Art Market, NFTs and the Metaverse

(23 Nov. 2021) – Artprice by Artmarket – whose reference shareholders are Server Group®, an Internet pioneer in Europe since 1985, and Cision® (PR Newswire) – are pleased to announce the extension of their globally unique alliance for the distribution of news feeds to 119 countries.

Artprice Metaverse

© ‘Alchemical Fractal 2’ (collection of 999 works), raw steel, NFT sculpture and algorithm by thierry Ehrmann.

Courtesy of Organe Museum / Abode of Chaos / La Demeure du Chaos

© ‘Alchemical Fractal 2’ (collection of 999 works), raw steel, NFT sculpture and algorithm by thierry Ehrmann.

Courtesy of Organe Museum / Abode of Chaos / La Demeure du Chaos

artprice-nft.com

This extended partnership confirms Cision as the official distributor of news and content for the World Leader in Art Market information, Artprice by Artmarket.

According to Frédéric Dumas, Cision France’s Sales Vice-President : “Cision supports global brands that are respected around the world. Pursuing and strengthening our partnership with Artmarket.com gives Cision the opportunity to be at the forefront of current events in the Art Market, Blockchain, the world of NFTs and the Metaverse.”

For thierry Ehrmann, founder of Artprice and CEO of Artmarket.com:” This alliance with Cision, now serving 119 countries, allows us to reach emerging countries on all continents, which already have a considerable lead over the ‘West’ in terms of crypto, Blockchain and NFTs. This strategic alliance is based on 21 years of mutual respect and daily practice between Cision PR Newswire and Artprice by Artmarket.

Over the past 120 years Cision has slowly but surely built a global news distribution network recognized by more than 100,000 reputable clients in the financial sector. Cision is also the global leader in PR & Influence Software.

With its database of 1.6 million journalists and media outlets, Cision diffuses high value-added news and information to all five continents of the globe.

This latest agreement is the direct result of the long-standing relationship over two decades between Artprice and Cision, both powerful leaders in their respective markets.

According to thierry Ehrmann: “Cision’s newswire exceeds industry standards for news dissemination. It allows Artprice to reach a larger public, which now represents approximately 900 million art enthusiasts, collectors, market professionals (galleries, auction houses and institutions/museums) and has recently expanded to include a whole new younger population of artists, creators and consumers galvanized by the art market’s links with the crypto-verse and the emergence of NFTs and the Metaverse”.

This geographically extended daily newsfeed will reach deep into 119 ‘developed’ and ‘emerging countries. Some of the latter are at forefront of the NFT phenomenon, carried by communities of artists who are changing the world to a new paradigm where the artist becomes the principal player at the very heart of the art market. This evolution is perfectly in line with our long held convictions and our recent Manifesto.

Artprice already has an open community of 765,000 artists and 5.4 million actively contributing members, including 4.5 million collectors and art enthusiasts as well as 900,000 art professionals.

Through this alliance with Cision – now extended to 119 countries – Artprice by Artmarket is reaching out to new worlds… and their parallel universes.

#ArtMarket by #ARTPRICE $ PRC #NFT #CryptoArt #metaverse #DigitalArt #NFTs #MarketPlace #BTC #ETH #OpenSeaNFT #raribleNFT #Ethereum #Manifesto

Images:

[https://imgpublic.artprice.com/img/wp/sites/11/2021/11/image1-artprice-metaverse-thierry-ehrmann-organ-museum-002.jpeg][https://imgpublic.artprice.com/img/wp/sites/11/2021/11/image2-artprice-NFT-bill.jpg]

About Cision / PR Newswire:

Cision, a brand promotion company, is the global leader in Earned Media, PR & Influence software for communications professionals. Cision allows communicators to identify and engage with their key journalists and influencers, develop and distribute content and measure the impact of their campaigns: TV, Radio, Press, Web and Social Networks. Cision has a workforce of over 4,000 employees and offices in 22 different countries (Americas, EMEA, APAC).

Copyright 1987-2021 thierry Ehrmann www.artprice.com – www.artmarket.com

- Don’t hesitate to contact our Econometrics Department for your requirements regarding statistics and personalized studies: econometrics@artprice.com

- Try our services (free demo): https://www.artprice.com/demo

- Subscribe to our services: https://www.artprice.com/subscription

Artprice by Artmarket publie le Rapport du Marché de l’Art Contemporain 2021 au coeur de la Frieze et la FIAC, en croissance de +2700% en 21 ans et +117% en valeur en 2020, poussé par les NFT

Selon thierry Ehrmann, Président d’Artmarket.com et Fondateur d’Artprice : « La création contemporaine a mieux résisté à la crise sanitaire plus que toute autre période, grâce à une stratégie d’offre toujours dense, plus abordable avec une demande croissante de collectionneurs multi-générationnels.

La période juillet 2020 à juin 2021 signe le meilleur exercice de l’histoire des enchères, en termes de lots vendus et de produit de ventes. Cette performance distingue l’Art Contemporain de toutes les autres périodes de création.

L’arrivée fracassante des NFT et les prix étourdissants obtenus pour les œuvres de très jeunes artistes ont transformé en profondeur le paysage du Marché de l’Art. Et nous sommes, avec les NFT, aux prémices d’une révolution qui va bouleverser le Marché de l’Art mondial, avec des rapports de force Hegeliens où l’artiste, aboli de sa condition d’asservi, devient le Maître du Marché.

L’une des plus grandes mutations est la formidable ouverture du Marché à l’Est. Cette année, Hong Kong s’impose comme la deuxième ville du Marché de l’Art Contemporain après New York.

Qui aurait pu imaginer que le Marché de l’Art Contemporain connaîtrait une hausse de +2700% en volumes en 21 ans et un indice des prix de l’Art Contemporain en forte progression de +117% et une présence intégrale sur les 5 continents ?

En tant que sculpteur plasticien depuis plus de 35 ans et concepteur du « Musée du Futur » (dixit L’Obs https://youtu.be/29LXBPJrs-o) avec le Musée d’Art Contemporain L’Organe gérant La Demeure du Chaos, je crois qu’en 2021, dans une société qui est en train de tuer toute forme de singularité, l’Art Contemporain reste le dernier geste singulier qui affirme la présence de l’humain d’où cette passion croissante d’Art avec désormais 120 millions de collectionneurs, de professionnels et art lovers. »

Le Rapport du Marché de l’Art Contemporain 2021 d’Artprice by Artmarket, annoncé en exclusivité par l’AFP ce 04 octobre 2021 avec les chiffres clés, est désormais en ligne ce 05/10/2021 dans son intégralité. Cet outil indispensable pour les grandes foires d’automne, la Frieze et la Fiac notamment, est accessible gratuitement à l’adresse suivante :

https://fr.artprice.com/artprice-reports/le-marche-de-lart-contemporain-2021

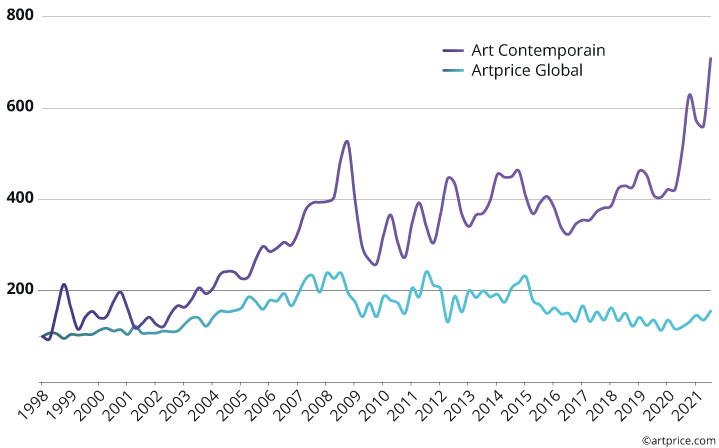

Indice Global des prix Artprice Vs. Indice des prix de l’Art Contemporain

Chiffres clefs :

Cette performance distingue l’Art Contemporain de toutes les autres périodes de création.

102 000 œuvres contemporaines vendues aux enchères sur 12 mois (juillet 2021 à juin 2021) pour un total de 2,7Mrd$.

+ 117 % par rapport au chiffre d’affaires de l’exercice 2019 / 2020, qui avait connu une chute de -34 %.

L’Art Contemporain pèse 23 % du Marché de l’Art en 2020 / 2021, contre 3 % en 2000 / 2001.

C’est 8 fois plus de lots vendus et 27 fois plus de valeur qu’il y 20 ans.

L’offre n’a jamais été aussi diversifiée et si bien adaptée à la demande, avec 70 % des œuvres vendues.

34 600 signatures contemporaines, dont 1 300 entrées et 5 000 records personnels.

770 Maisons de Ventes, réparties dans 59 pays, se répartissent les ventes d’Art Contemporain aux enchères.

Christie’s (32 %), Sotheby’s (26 %) et Phillips (10 %) concentrent 2/3 du chiffre d’affaires.

New York et Hong Kong cumulent 60 % de la valeur mondiale des ventes d’Art Contemporain.

La peinture est la catégorie reine, en termes à la fois de valeur (73 %) et de lots vendus (42 %).

Les toiles comptent 82 % des résultats millionnaires, contre 6 % pour le dessin et 6 % pour la sculpture.

Les NFT cumulent déjà neuf résultats millionnaires, soit trois fois plus que les photographies.

L’indice des prix de l’Art Contemporain a grimpé de +400 % depuis 2000 et +2700 % en volume.

Le prix de la peinture In This Case (1983) de Basquiat était de 1m$ en 2002, contre 93m$ en 2021.

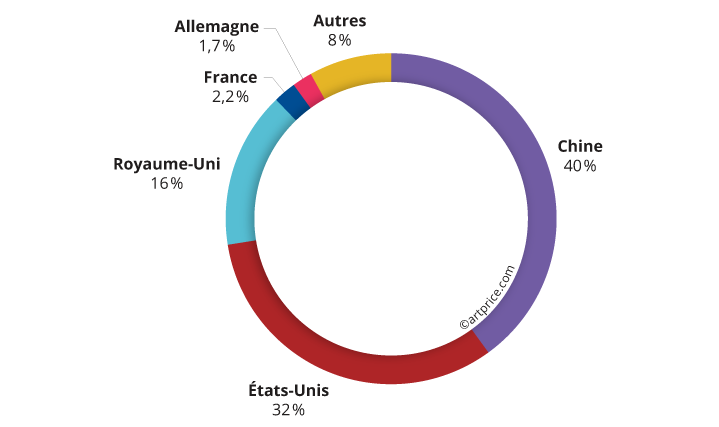

Avec 40 % du produit de ventes, la Chine devient la 1ère plaque tournante d’Art Contemporain.

Sans surprise, les USA (32 %) et le Royaume-Uni (16 %) complètent le podium.

Hong Kong réalise une croissance exceptionnelle de +277 % et dépasse Londres.

Pékin s’affirme elle-aussi sur le Marché de l’Art Contemporain avec 305m$ (+161 %).

Paris est la 5ème place de marché, avec 55 m$, de plus en plus loin de ses concurrentes.

Grâce à la vente du 1er NFT pour 69m$, Beeple pèse 3 % du Marché de l’Art Contemporain à lui seul.

Banksy entre dans le top 5 toutes périodes confondues, derrière Picasso, Basquiat, Warhol et Monet.

À 34 ans, la peintre américaine Avery Singer voit une de ses toiles dépasser les 4m$ aux enchères.

FRIEZE VS FIAC :

Londres accueillera la Frieze où les musées, galeries et Maisons de Ventes montrent la force de la place de marché londonienne deux semaines avant que Paris n’attire le Marché de l’Art international avec la FIAC.

Si la capitale anglaise n’a pas grand chose à craindre de la capitale française (deux fois moins performante sur le marché des enchères), elle doit toutefois s’inquiéter de la montée en puissance de Hong Kong. L’ancienne colonie britannique est ultra attractive sur le marché haut de gamme pour l’Art Contemporain et cumule 962 m$ sur le seul S1 2021, tandis que le Royaume-Uni totalise 1,2 Mrd$.

Londres reste néanmoins incontournable sur le Marché de l’Art Moderne (avec la vente cette année d’un très beau tableau de Kandinsky) et continue de voir la cote de Banksy s’envoler, grâce à un nouveau record à 23,3 m$. Le street artiste anonyme, originaire de Bristol, est désormais l’artiste vivant le plus performant du monde aux enchères.

Ce rapport analyse le Marché de l’Art Contemporain (artistes nés après 1945) sur la base des résultats de ventes aux enchères publiques de Fine Art enregistrés dans le monde entre le 1er juillet 2020 et le 30 juin 2021.

Il concerne uniquement les peintures, sculptures, installations, dessins, photographies, estampes, vidéos et NFTs, à l’exclusion des biens culturels anonymes et du mobilier. Toute mention $ fait référence au prix d’adjudication avec frais acheteurs, converti en dollar américain au jour de la vente.

Méthodologie :

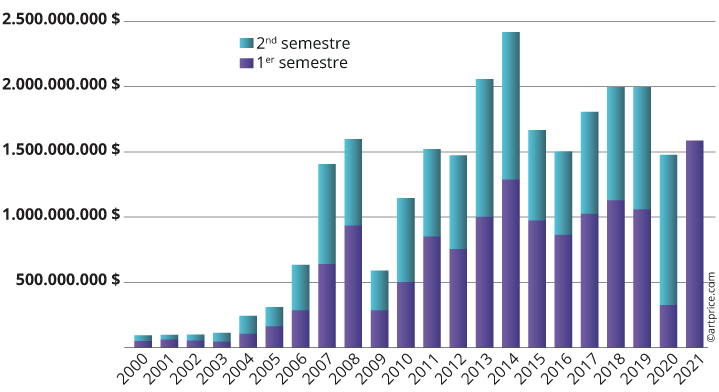

2021, un cru d’exception :

Le segment des artistes nés après 1945 réalise une performance historique au S2 2021, en hausse de +50% par rapport au S1 2019 (5 fois plus qu’au S1 2020, endigué par l’arrivée de la crise sanitaire).

La performance historique du S1 2021 (1,58Mrd$) a été rendue possible par l’adaptation du Marché de l’Art Contemporain dès le S2 2020. Elle reflète une transformation réussie grâce au développement des ventes digitales et aux nouveaux acheteurs récemment conquis par l’Art Contemporain.

L’accélération est particulièrement bénéfique aux États-Unis (592m$ au S1 2021), à Hong Kong (435m$), mais aussi en Allemagne (21,7m$). Les trois pays n’avaient jusqu’alors jamais réalisé de semestre aussi fructueux sur le segment contemporain.

Le Marché de l’Art Moderne (-8%) et celui de l’Après-Guerre (-4%) n’ont pas encore retrouvé pour leur part les niveaux d’intensité qui prévalaient avant la crise sanitaire. Cette différence profite à l’Art Contemporain, qui pèse désormais 23% du produit de ventes de Fine Art, contre 3% il y a 20 ans. Jean-Michel Basquiat, avec plus de 300m$ engrangés en six mois (deux fois plus qu’Andy Warhol), tient à lui seul 4,3% du Marché de l’Art mondial aux enchères, toutes périodes de création confondues.

Produit de ventes semestriel aux enchères d’Art Contemporain dans le monde

Asie, le Marché pivote vers l’Est :

Après une année 2020 extrêmement contrainte, la Chine, Hong Kong et Taïwan, surperforme : le milliard d’œuvres contemporaines vendues en 12 mois représente 40% du volume d’affaires mondial.

Le marché asiatique devient donc la première plaque tournante de l’Art Contemporain, pour les artistes asiatiques certes, mais aussi pour un grand nombre d’Occidentaux. Ce phénomène nouveau témoigne d’un marché toujours plus solide et actif à l’Est du planisphère.

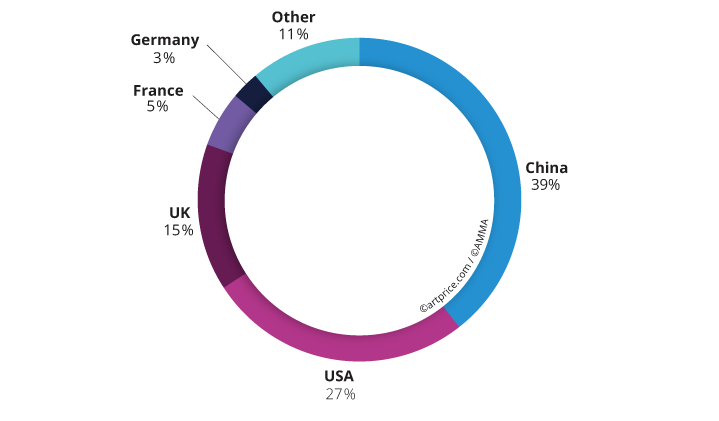

Distribution géographique du produit des ventes d’Art Contemporain (2020/21)

Tendances : 4 artistes représentatifs

Banksy (1971) – Le Street Art reconnu comme une discipline majeure et mondialisée

À 47 ans, le Street artiste anonyme fait partie des cinq signatures les plus performantes du monde en salles de ventes, toutes périodes de création confondues.

Sur le segment spécifiquement contemporain, il se classe en deuxième position derrière Basquiat, fort d’un volume d’affaires de 181m$, représentant 7% du résultat mondial. C’est un record absolu pour l’un des trois artistes les plus demandés du marché.

Depuis cinq ans, le chiffre d’affaires de Banksy croît de façon exponentielle : 3m$ en 2016, 7m$ en 2017, 16m$ en 2018, 29m$ en 2019, 67m$ en 2020 et 123m$ au S1 2021.

Amy Sherald (1973) – Woman Power

L’un des coups de marteau les plus retentissants de l’année revient à Amy Sherald, l’artiste à qui l’on doit le portrait officiel de Michelle Obama en 2018, représentée depuis par la galerie Hauser & Wirth.

Sa toile The Bathers (2015) a été enlevée pour un impressionnant coup de marteau à 4,26m$ le 7 décembre chez Phillips, soit 21 fois son estimation haute. La toile représente deux femmes noires en maillots de bain colorés sur un fond bleu. Six mois après cette vente, Phillips a constaté une nouvelle envolée de prix depuis New York avec It Made Sense… Mostly In Her Mind (2011) attendue entre 500.000$ et 700.000$, mais disputée à plus de 3,5m$.

Ces deux résultats pulvérisent l’ancien record de l’artiste, fixé à 350.000$ en 2019.

Beeple (1981) – La folie virale des NFT

Inconnu aux enchères publiques l’an dernier, Beeple figure cette année parmi les trois artistes les plus chers de leur vivant, après David Hockney et Jeff Koons.

En un coup de marteau aussi virtuel que retentissant, il remporte la deuxième meilleure adjudication de l’année pour l’Art Contemporain. La vente du premier NFT aux enchères publiques (Everydays: The first 5000 Days) se solde par un record de 69,3m$, alors que son prix de départ était de 100$ et que l’artiste échappait à tous les radars: pas de galerie, pas d’exposition, pas de ventes aux enchères…

“Seulement” plusieurs millions de followers sur Instagram et le soutien de Christie’s, l’une des plus vieilles et des plus honorables Maisons de Ventes de la planète.

Amoako Boafo (1984) – Le Marché de l’Art vit aussi son Black Live Matters

Autre signature désormais incontournable du marché international, Amoako Boafo a fait une entrée fracassante dans les ventes hongkongaises, remportant son record personnel : 1,14m$ pour la toile Baba Diop vendue 10 fois son estimation basse, le 2 décembre 2020 chez Christie’s.

Peu étonnant dans ces circonstances que son dessin Untitled (Two Hands) ait encore décuplé son estimation optimiste le lendemain, toujours chez Christie’s Hong Kong.

Copyright 1987-2021 thierry Ehrmann www.artprice.com – www.artmarket.com

Le département d’économétrie d’Artprice répond à toutes vos questions relatives aux statistiques et analyses personnalisées : econometrics@artprice.com

En savoir plus sur nos services avec l’artiste en démonstration gratuite :

https://fr.artprice.com/demo

Nos services :

https://fr.artprice.com/subscription

A propos d’Artmarket.com :

Artmarket.com publishes Artprice 2020 Art Market Report highlighting a veritable paradigm shift: the pandemic imposed an unprecedented digitization of the market… that saved auction turnovers.

Our 23rd Annual Art Market Report offers a global analysis of public sales of Fine Art – painting, sculpture, drawing, photographs, prints, installations – between 1 January and 31 December 2020.

What was, at one point, anticipated as a ‘blank year’ for the Art Market, turned out to be much more positive than expected. The cancellation of fairs, exhibitions and all sales in March 2020 prompted fears of a complete shutdown of the art industry. But unlike museums, which have suffered the full impact of covid-related restrictions, the auction houses quickly found ways to preserve the core of their activities thanks to the dematerialization via digital technology: versus 2019, they maintained 79% of their turnover and sold a volume of lots equivalent to 91% of the previous year’s total.

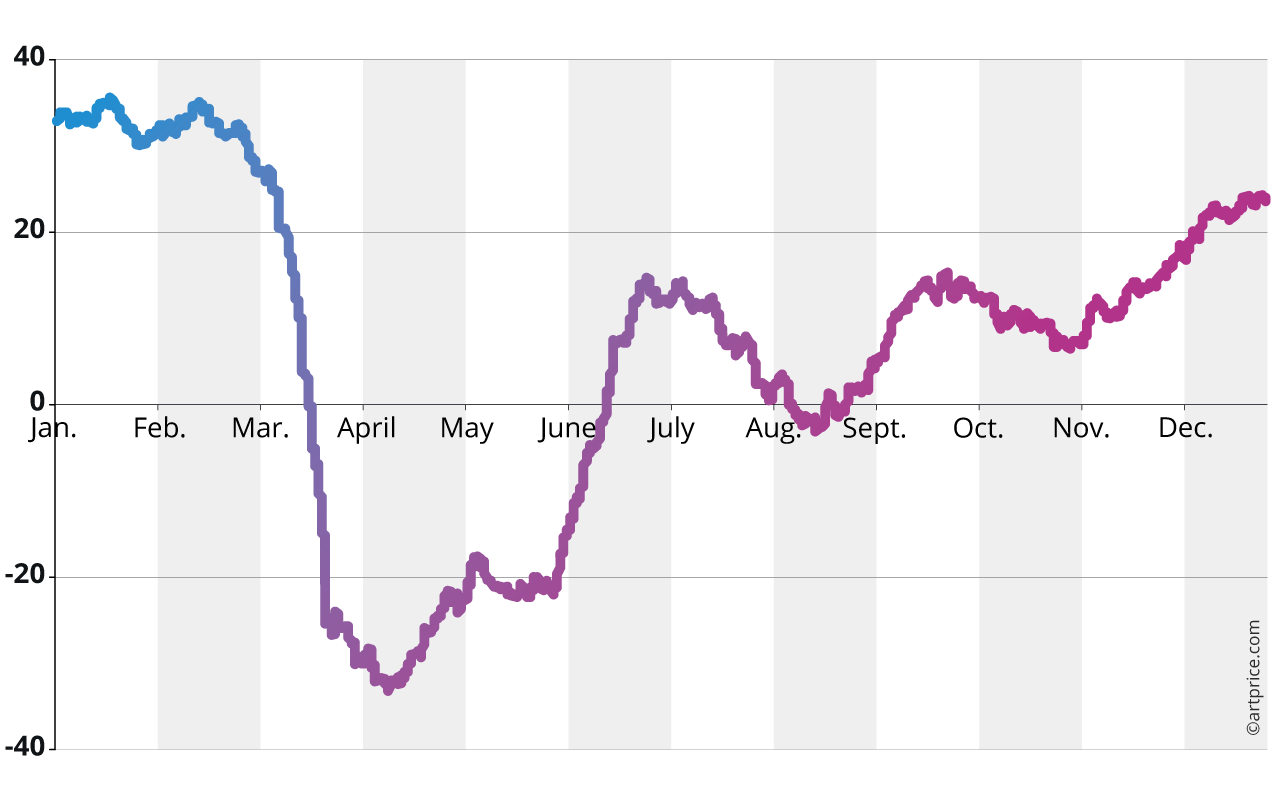

Artprice’s Art Market Confidence Index in 2020 * AMCI: Art Market Confidence Index

Our 2020 Art Market Report is available free of charge, in full, and in three languages, both online and as a PDF file:

- French: https://fr.artprice.com/artprice-reports/le-marche-de-lart-en-2020

- English: https://www.artprice.com/artprice-reports/the-art-market-in-2020

- Mandarin: https://zh.artprice.com/artprice-reports/zh-the-art-market-in-2020

thierry Ehrmann, President and Founder of Artmarket.com and its Artprice department, is pleased to announce the free publication of the 23rd Annual Art Market Report (2020):

“The pandemic which took the world by surprise has forced Art Market professionals to accelerate a digitization process that they had been procrastinating for too long. Twelve months ago, this industry still showed a certain resistance to anything related to digital culture, which resulted in a reluctance to implement effective IT tools. In contrast to this delay, which has left much of the art sector almost thirty years behind the rest of the economy, Artprice has never stopped innovating and preparing the ground for the inevitable future.

So it is with much enthusiasm – despite the situation – that our group has supported all the key actors of the Art Market to take on a historic challenge… to repair in just a few months (sometimes even just a few weeks) three decades of obstinacy”.

Art Market 2.0

The Art Market has adopted a new economic model and reached a new equilibrium that the most optimistic projections were not expecting to see before 2025. It is now much better equipped to work with contemporary ways of living and collecting, i.e. those of the 21st century.

With this 23rd Annual Report, Artprice and its editorial partner Artron are proud to provide a global analysis of this paradigm through a focus on the following questions:

- How has the pandemic impacted the art market?

- How has digital technology affected the market and what will tomorrow’s market look like?

- Why has China’s market resisted so well?

- How have collectors reacted?

- What types of works are most in-demand?

- Which artists have reached records despite the crisis?

- How have social-cultural upheavals – from #MeToo to Black Lives Matter – impacted the Art Market?

The report also contains Artprice’s famous Top-500 ranking of the world’s most sought-after artists and a month-by-month breakdown of the highlights of the art market in 2020 as it struggled to meet the unprecedented challenges prompted by the health crisis.

China in pole position

The report underscores the place China now holds on the global Art Market: that of the most serious competitor to the United States. Although the Chinese art market has its own codes, it is more interesting for that reason and it makes for a particularly substantial and fascinating editorial partnership between Artprice and Artron.

Top 10 countries by Fine Art auction turnover (change vs 2019)

1. China (Artron): $4,163,871,200 (+2%)

2. United States: $2,804,272,300 (-39%)

3. United Kingdom: $1,552,937,500 (-30%)

4. France: $578,347,600 (-31%)

5. Germany: $298,834,000 (+11%)

6. Italy: $142,404,000 (-32%)

7. Switzerland: $110,967,500 (+5%)

8. Japan: $95,366,400 (-14%)

9. Austria: $91,117,515 (-8%)

10. Poland: $89,672,059 (+1%)

Geographical breakdown of Fine Art auction turnover in 2020

Looking at our other key market indicators, the Artprice100© benchmark index has increased by +405% since 1 January 2000. In 2020, this blue-chip artists index posted an increase of +1.8%.

Contemporary Art, both in the West and in Asia, is still the locomotive of the Art Market, despite the pandemic context.

In sum, despite a global tragedy that is unique in social and modern economic history, the Art Market has rebounded via digital technology, which it has massively adopted within a record time and which has allowed the market’s turnover contraction to be limited to just -21%, which in itself – given the circumstances – is a superb performance.

Images:

[https://imgpublic.artprice.com/img/wp/sites/11/2021/03/1-EN-AMCI-Art-Market-Confidence-Index.png]

[https://imgpublic.artprice.com/img/wp/sites/11/2021/03/2-EN-FINEART2020.png]

Copyright 1987-2021 thierry Ehrmann www.artprice.com – www.artmarket.com

- Don’t hesitate to contact our Econometrics Department for your requirements regarding statistics and personalized studies: econometrics@artprice.com

- Try our services (free demo): https://www.artprice.com/demo

- Subscribe to our services: https://www.artprice.com/subscription

Artmarket.com publie le Rapport du Marché de l’Art Artprice en 2020, changement de paradigme : la pandémie a imposé une digitalisation sans précédent du marché qui sauve le CA des ventes publiques

Ce 23ème Rapport Annuel du Marché de l’Art offre une lecture mondiale des ventes publiques de fine art – peinture, sculpture, dessin, photographie, estampe, installation – entre le 1er janvier 2020 et le 31 décembre 2020.

Ce qui avait d’abord été anticipé comme une année blanche sur le Marché de l’Art s’est révélé bien plus positif que prévu. L’annulation des foires, des expositions et de toutes les ventes, en mars 2020, avait fait craindre un arrêt complet de cette industrie. Mais contrairement aux Musées, entièrement soumis aux restrictions sanitaires, les Maisons de Ventes ont rapidement trouvé le moyen de préserver le cœur de leurs activités grâce la dématérialisation par le numérique : 79 % du produit de ventes et 91 % des lots vendus ont été maintenus aux enchères.

Indice de Confiance du Marché de l’Art Artprice sur l’année 2020 – AMCI : Art Market Confidence Index

Le Rapport du Marché de l’Art en 2020 est disponible gratuitement, en intégralité et en trois langues, en ligne ainsi qu’en version PDF :

- Français : https://fr.artprice.com/artprice-reports/le-marche-de-lart-en-2020

- Anglais : https://www.artprice.com/artprice-reports/the-art-market-in-2020

- Mandarin : https://zh.artprice.com/artprice-reports/zh-the-art-market-in-2020

thierry Ehrmann, Président et Fondateur d’Artmarket.com et de son département Artprice, est heureux d’annoncer la publication gratuite du 23ème Rapport du Marché de l’Art en 2020 :

« La pandémie qui s’est abattue de façon inattendue sur le monde a obligé les acteurs du Marché de l’Art à accélérer un processus de digitalisation qu’ils repoussaient depuis trop longtemps. Il y a douze mois encore, cette industrie montrait une certaine réserve pour tout ce qui touchait à la culture du numérique qui se traduisait par une réticence à mettre en place des outils informatiques efficaces. Face à ce retard de près de 30 ans, Artprice n’a eu de cesse d’innover et de préparer le terrain.

Aussi c’est avec grand enthousiasme, malgré la situation, que notre groupe a accompagné l’ensemble des acteurs du Marché de l’Art pour relever un défi historique et rattraper en quelques mois (parfois même en quelques semaines) trois décennies d’obstination. »

Le Marché de l’Art 2.0

Le Marché de l’Art a échafaudé un nouveau modèle économique et atteint un nouvel équilibre que les projections les plus optimistes prévoyaient en 2025. Il est désormais beaucoup mieux adapté pour faire face à cette autre manière de vivre et de collectionner, qui est celle du 21ème siècle.

Artprice et son partenaire éditorial exclusif Artron sont fiers de fournir une grille de lecture globale de cette transformation, avec ce 23ème Rapport Annuel :

- Comment la pandémie a-t-elle impacté le Marché de l’Art mondial ?

- Quelles sont les évolutions numériques et comment se dessine le marché de demain ?

- Pourquoi les performances ont augmenté malgré la crise en Chine ?

- Comment ont réagi les collectionneurs ?

- Quels types d’œuvres sont les plus demandées ?

- Quels artistes ont atteint des records malgré la crise ?

- Comment les bouleversements sociaux-culturels – de #MeToo à Black Lives Matter – ont impacté le Marché de l’Art ?

Ce rapport contient également le célèbre classement Artprice des 500 artistes les plus performants au monde mais aussi un nouveau calendrier pour revenir, mois par mois, sur les grands moments du Marché de l’Art face aux défis inédits liés à la crise sanitaire en 2020.

La Chine en première position

Ce Rapport tient à donner à la Chine la place qui est désormais la sienne sur le Marché de l’Art : celle de la plus sérieuse concurrente des États-Unis. Si son marché possède ses propres codes, il n’en est que plus intéressant et c’est la raison pour laquelle le partenariat éditorial entre Artprice et Artron est conséquent et passionnant.

Top 10 pays par produit de ventes fine art aux enchères (Evolution vs 2019)

- 1. Chine (Artron) : 4 163 871 200 $ (+2%)

- 2. États-Unis : 2 804 272 300 $ (-39%)

- 3. Royaume-Uni : 1 552 937 500 $ (-30%)

- 4. France : 578 347 600 $ (-31%)

- 5. Allemagne : 298 834 000 $ (+11%)

- 6. Italie : 142 404 000 $ (-32%)

- 7. Suisse : 110 967 500 $ (+5%)

- 8. Japon : 95 366 400 $ (-14%)

- 9. Autriche : 91,117,515 $ (-8%)

- 10. Pologne : 89,672,059 $ (+1%)

Répartition géographique du produit des ventes aux enchères de Fine Art en 2020

[https://imgpublic.artprice.com/img/wp/sites/11/2021/03/2-FR-FINEART2020.png]

D’autre part, l’indice de référence Artprice100© a progressé de +405% depuis le 1er janvier 2000. Cet indice Artprice100© des artistes Blue-chips du marché de l’art a progressé de +1,8% sur l’année 2020.

L’Art Contemporain, tant en Occident qu’en Asie, est toujours la locomotive du Marché de l’Art, malgré le contexte de la pandémie.

Enfin, le Marché de l’Art, malgré une tragédie mondiale unique dans l’histoire de l’économie moderne, a su rebondir par le numérique qu’il a totalement investi en un temps record, ce qui a permis de limiter la chute du chiffre d’affaires à -21 %, ce qui en soi-même, compte tenu des circonstances, est une véritable performance.

Images :

[https://imgpublic.artprice.com/img/wp/sites/11/2021/03/1-FR-AMCI-Art-Market-Confidence-Index.png]

[https://imgpublic.artprice.com/img/wp/sites/11/2021/03/2-FR-FINEART2020.png]

Copyright 1987-2021 thierry Ehrmann www.artprice.com – www.artmarket.com

.

Le département d’économétrie d’Artprice répond à toutes vos questions relatives aux statistiques et analyses personnalisées : econometrics@artprice.com

En savoir plus sur nos services avec l’artiste en démonstration gratuite :

https://fr.artprice.com/demo

Nos services :

https://fr.artprice.com/subscription

.

Artprice’s 2018 Annual Art Market Report: record number of global Fine Art auction transactions since 1945 and greater buyer selectivity…

Fruit of the alliance between Artprice, world leader in Art Market information (founded and directed by thierry Ehrmann), and Artron, its powerful Chinese institutional partner (directed by Wan Jie), our 21st Annual Art Market Report* allows a truly balanced perspective of the global market that covers both the West and the East.

thierry Ehrmann: “By pooling their resources, the two entities can analyse the global Art Market in unprecedented detail, highlighting the intense competition driving the market’s global growth and its overall impact. No other organisation is currently capable of producing such high quality macro- and micro-economic metadata generated by Big Data and AI algorithms”.

WAN Jie – Artron / thierry Ehrmann – Artprice

The report includes Artprice’s now famous ranking of the world’s 500 most powerful artists, the Top-100 auction results of the year, information regarding our Artprice100® index now used in trading rooms, analyses by country and by capital, analyses by creative periods and by artistic media… and a selection of Artprice market indices.

Its 18 key chapters provide an uncompromising and unprecedented analysis of today’s global Art Market. The Report can be downloaded in pdf format, free of charge, at Artprice.com.

This 21st Annual Report* on the Global Art Market is distributed exclusively worldwide by Artprice and Cision, who have together set up the world’s first press agency dedicated to Art Market news and information – Artpress agency® – an area in which Artprice is world leader.

See Cision’s press release to the NYSE https://www.prnewswire.com/news-releases/artprice-and-cision-enter-distribution-partnership-300770437.html?=prn )

For 120 years Cision (PR Newswire) has been building a global news and information dissemination platform. Today that platform is used by more than 100,000 major clients in the financial sphere and it reaches approximately 1.8 billion people. With its database of 1.6 million journalists and media across 5 continents, Cision is the world’s leading provider of software for the management of public & press relations and the identification of influencers and key media.

Read our 21st Annual Report* on the Global Art Market for free at:

https://www.artprice.com/artprice-reports/the-art-market-in-2018

*Public sales of Fine Art: painting, sculpture, drawing, photography, prints, installations. Period analysed: 1 January 2018 – 31 December 2018

The Art Market enters a new era on the back of excellent growth

General synopsis

• Global Fine Art auction turnover reached $15.48 billion over the twelve months of 2018

• 538,000 artworks changed hands at auction in 2018: an absolute record since 1945

• Global turnover was up +4%, for a third consecutive year of expansion

• David Hockney became the world’s most valued living artist (with a result of $79.77 million)

• Jenny Saville became the world’s most valued living female artist ($12.49 million)

• The unsold rate remained stable at 36% in the West

• In China, the unsold rate dropped significantly by 14 points

• The Artprice100© index of blue-chip artists showed a +4.3% progression

Soft Power

• The US (up +18%) and the United Kingdom (up +12%) drove Western growth

• The US was again the world’s leading market with $5.8 billion (37.9% of global turnover)

• China is in second place with $4.5 billion

• France was 4th with 4.5% of global turnover ($694 million), down 10% vs. 2017

• Christie’s remained the world’s leading Fine Art auction operator, with $5 billion, ahead of Sotheby’s with $3.9 billion

• In China, Poly Auction ($654 million) outperformed China Guardian ($606 million)

• Phillips ranked 4th in the global ranking of Fine Art auction operators with $653 million

• Christie’s (up +13%), Sotheby’s (up +16%) and Phillips (up +39%) all posted progressions

• In Europe, the German auctioneer Dorotheum posted $79 million and the French company Artcurial posted $76 million

Trends

· Modern Art dominates the high-end market with 8 of the Top-10 results

· 159 European artists ranked in the Top 500, versus 153 Asian and 93 North American

· Abstract art reached new heights with Malevich, Zao Wou-Ki, Soulages, Motherwell, etc.

· African American Art in the spotlight with Kerry James Marshall (# 67) and N.A. Crosby (# 426)

· Female artists in vogue with records for Joan Mitchell, Cecily Brown, Jenny Saville, etc.

Financial returns

· Repeat sales* generated an average annual return ranging from +6.2% to +8.2%

· Works bought from $200,000 to $1 million generate the highest annual return: + 8.2%

*The same work bought at auction and resold at auction during 2018

Artprice100© “The Wolves of Wall Street at the gates of the Art Market”

The Artprice100® index shows an increase of +380% since 2000

Or an annual average return of +8.6%

Eight artists changes in our Artprice100® index between fiscal year 2017 and 2018

In 2000, only 1 Chinese artist (Zhang Daqian) qualified for inclusion in our Artprice100® index compared with 16 in 2017

An efficient, liquid and transparent Art Market, similar to a financial market.

In a world where many Western countries now post quarterly economic growth rates well below 1%, the Art Market has once again confirmed its efficiency, liquidity and transparency… just like a financial market.

In 2000, the global Art Market posted a global auction turnover of $3.2 billion. In 2018, the figure was $15.48 billion, up 380% versus 2000.

The strength of the Art Market is related to its unparalleled level of selectivity over the past twelve years, very much in line with Artprice’s dictum “Buy the right work, from the right period, with a good story, by the right artist, at the right time.”

The formula is simple but exceptionally efficient and explains the Western market’s almost “perfect” unsold rate of 36%.

Let’s not forget that the unsold rate has acted as a key benchmark for 120 years, indicating whether the market is in speculative mode (unsold rate under 20%) or in free fall (above 60%). According to the famous Art Market sociologist, Raymonde Moulin, 36% is the right balance.

A spectacular increase in transactions with 538,000 works sold in 2018, an absolute record since 1945, despite the relative torpidity of the global economy.

Driven by a healthy combination of investment logic, speculative buying, passionate collecting and insatiable demand for major signatures to ‘populate’ the world’s new museums, the global Art Market posted a dynamic level of activity in 2018 with 538,000 transactions, the highest annual figure since 1945, despite the relative stagnation of the global economy.

2018’s global auction turnover total was very impressive with an overall figure of $15.48 billion.

The drivers of this growth are ease of access to Art Market information, electronic sales (98% of the market’s participants are connected to the Internet), the financialization of the market, a growing population of ever-younger art consumers (from 500,000 in the 1950’s to 120 million in 2018) and the extension of the market to the entire Asia/Pacific area plus India, South Africa, the Middle East and South America.

A global economic reality in the 21st century, the museum industry® is driving the Art Market.

The growth of the museum industry is also playing a crucial role. With more than 700 new museums opening every year, the museum industry has become a global economic reality in the 21st Century. More museums opened between 2000 and 2014 than in the previous two centuries.

This demand for museum-quality works is one of the key factors in the spectacular growth of the Art Market which is now a mature and liquid market offering returns of 8% per year on works purchased over $200,000.

In 2018, 26.2% of our Top 500 global artists are Chinese, illustrating the power of China vis-à-vis the United States which only account for 17.4% of the Top 500 artists.

Similarly, in 2018 Chinese artists accounted for 26.2% of the artists in our Top 500 ranking illustrating China’s strength vis-à-vis the United States, which account for just 17.4%. Apart from American and Chinese artists, Europeans account for 45.4% of the Top 500 artists and other nationalities account for 11%, including Africans (1.2%), Latin Americans (1.6%) and Asians from outside China (6.6%).

In view of these macro and micro-economic data, the Art Market has successfully functioned for 19 years as a safe haven against economic and financial crises, with consistent and recurring returns.

The Artprice100® index (an all-periods global index for Old Master, Modern and Contemporary Art) shows a +380% increase since 2000.

In a context where central banks, particularly the ECB, are implementing close to zero or negative interest rates, the Art Market has enjoyed insolent health with our new Artprice100® index showing a progression of +380% since 2000. These returns are not limited to big name artists.

Our analyses show that the average annual return on artworks purchased above the $20,000 threshold is around +5.5%.

Of the world’s 6,300 auction houses, 98% are today present on the Internet (versus just 3% in 2005).

The Internet (Microsoft estimates over 5.3 billion people are connected worldwide) has now become the principal and definitive forum for auction operators worldwide and they are using it to consolidate their market shares on all continents.

The Art Market is fully dematerializing with Blockchain, but also with 5G becoming reality in 2019.

The Art Market will be impacted by Blockchain, a technology that Artprice has already adopted. However, before that reality becomes generalised, 5G (latest generation of cellular mobile communications) represents a major technical revolution via its universal connectivity, and particularly via the connection of objects and machines, which Artprice and its partner Artron are experimenting in Beijing.

In fact, the 5G that is being implemented this year in the US and in Europe has existed for two years in China. The powerful alliance between Artprice and Artron has enabled beta testing of a multitude of key art market services and industrial processes that were unimaginable under 4G.

The Art Market is an efficient, historic and global market with a capacity to withstand economic and geopolitical crises that is now beyond any doubt. Over the last 18 years, it has outperformed the world’s principal investment markets by a considerable margin.

Copyright ©2019 thierry Ehrmann – www.artprice.com

Try our services (free demo):

https://www.artprice.com/artist/23640/baishi-qi

Subscribe to our services:

https://www.artprice.com/subscription

About Artprice:

Artprice is listed on the Eurolist by Euronext Paris, SRD long only and Euroclear: 7478 – Bloomberg: PRC – Reuters: ARTF.

Founded by thierry Ehrmann (see Who’s who certified Biography ) (c) https://imgpublic.artprice.com/img/wp/sites/11/2019/03/2019-bio-whoswho-thierry-ehrmann.pdf).

Dicover Artprice in video: https://www.artprice.com/video

Artprice is the global leader in art price and art index databanks. It has over 30 million indices and auction results covering more than 700,000 artists. Artprice Images® gives unlimited access to the largest Art Market resource in the world: a library of 126 million images or prints of artworks from the year 1700 to the present day, along with comments by Artprice’s art historians.

Artprice permanently enriches its databanks with information from 6,300 auctioneers and it publishes a constant flow of art market trends for the world’s principal news agencies and approximately 7,200 international press publications.

For its 4,500,000 members, Artprice gives access to the world’s leading Standardised Marketplace for buying and selling art. Artprice is preparing its blockchain for the Art Market. It is BPI-labelled (scientific national French label) Artprice’s Global Art Market Annual Report for 2018 published last March 2019: https://www.artprice.com/artprice-reports/the-art-market-in-2018

Artprice is associated with Artron Group the Chinese leader in the Art Market, its solid institutional partner.

About the Artron Group:

“Artron Art Group (Artron), a comprehensive cultural industrial group founded in 1993 by Wan jie, is committed to inheriting, enhancing and spreading art value. Based on abundant art data, Artron provides art industry and art fans with professional service and experience of quality products by integrated application of IT, advanced digital science and innovative crafts and materials.

Having produced more than 60,000 books and auction catalogues, Artron is the world’s largest art book printer with a total print volume of 300 million a year. It has more than 3 million professional members in the arts sector and an average of 15 million daily visits, making it the world’s leading art website.”

Artron’s Web: www.Artron.net

Artprice’s Contemporary Art Market Annual Report for 2017 – free access at:

Artprice’s press releases:

http://serveur.serveur.com/Press_Release/pressreleaseen.htm

https://twitter.com/artpricedotcom

Artmarket News:

https://twitter.com/artpricedotcom & https://twitter.com/artmarketdotcom

https://www.facebook.com/artpricedotcom 3.8 million subscribers

http://artmarketinsight.wordpress.com/

Discover the Alchemy and the universe of Artprice http://web.artprice.com/video, which headquarters are the famous Museum of Contemporary Art, the Abode of Chaos: https://issuu.com/demeureduchaos/docs/demeureduchaos-abodeofchaos-opus-ix-1999-2013

The Contemporary Art Museum The Abode of Chaos

https://www.facebook.com/la.demeure.du.chaos.theabodeofchaos999

3.5 million subscribers

Contact: ir@artprice.com

Art markets’ visibility: the alliance between Artprice, Artron and Cision

An obsolescent hegemony and the birth of competition.

By Aude de Kerros.

At the beginning of 2019, the international art market is experiencing an evolution that will likely have a profound impact on the existing global art market system. The event underlying this structural change is an unexpected and unprecedented strategic business alliance between three companies based on the creation and operation of databanks. Two are specialized in the field of art – both with an online sales capacity – and a third (Cision) selects information from the international press and feeds that information to the press and media directly concerned.

The alliance comes at the end of a decade that has seen a technological revolution in communication and a profound change in geopolitical power relations. Moreover, a clivage has emerged between a very high-end mainstream art market with global visibility, the ‘contemporary-international’ art market, and a whole series of ‘local’ markets that present an art considered ‘non-innovative’ that falls outside the sophisticated and intellectualised ‘art world’. It is in this context that a new partnership has been negotiated between Artprice, Artron and Cision.

– The creation of this game-changing triumvirate was triggered by the listed French art info company Artprice, founded and steered by a larger-than-life and non-conformist personality dedicated to the principle of maintaining his liberty and independence. Thierry Ehrmann is the creator of the most comprehensive databank on the global art market, an exhaustive databank that covers both ‘global financial art’ and ‘local non-sophisticated’ arts. The inclusion of the latter field is a mission that the French state has distinctly eschewed (at its own national level), since its archiving work only covers ‘state-recognised’ conceptual/contemporary artists.

– Artron is a Chinese institutionnal company founded in 1993 that aims to promote art and creation in China, providing all of the requisite tools to foster a thriving art sector in a country where the auction market was almost non-existent under the communist regime. It has also built up a comprehensive database that includes all currents of Chinese art.

– Cision is a press observer and distributor, headquartered in Chicago, providing tailored relationships with global media outlets to the world’s influencers and communication strategists.

CARTELS AND MONOPOLIES BEWARE!

Thierry Ehrmann is a Robin Hood character with a strong allergy to monopolies and intermediaries which he hounds relentlessly. Over the years he has turned this allergy into a positive mission to release the art world from its economic and intellectual predators. By analysing the data collected in the Artprice databanks he realised that the high-end global art market, referenced in New York, has a hegemonic visibility around the entire globe; a supply market, without real roots and without any real competition. He also realised that the ‘real’ market, a demand driven market, is infinitely larger, but under-developed due to a lack of visibility.

By contrast, the hegemonic market thrives through a highly interconnected international network, sharing common interests, holding fairs, auctions, exhibitions in museums and international galleries. Its business model combines two levels: a market that closely resembles a pure financial market, secured by collectors operating within a closed circuit, and a mass market occupied by derivative arty objects produced industrially in limited series in all prices and formats (from gallery replicas to keyrings and t-shirts). This latter market effectively translates the original works – which often fetch massive sums at auctions – into ‘promotional icons’.

Together (i.e. the high-end plus its low-end sister), this market owes its legitimacy to its profitability and its various different utilities: simultaneously a ‘social’ and a business platform, generating urban events, tourist attractions, fuelling the museum industry etc. The Global Financial Art system, which provides incomes for a lot of people, also benefits from donations (tax-free of course) from patrons, companies, institutions, as well as subsidies from certain states.

For Thierry Ehrmann, this market is built around a cluster of arcane agreements, in its own image

His databanks of objective information give him prime access to the market’s key information and the analytical firepower behind an inspired strategy. He was the first to note that China had become the world’s leading art market as early as 2009, ahead of America. This fact has attracted little comment, with the media pretending it is insignificant. Thierry Ehrmann quickly understood the impossibility of claiming ownership to a planetary databank that did not include data from the Chinese market, which is difficult to access because of the language obstacle and the Internet barrier. This reality inspired Ehrmann to create links with the Chinese agency Artron and, subsequently, to form an official alliance with Artron in September 2018.

As Artprice has already done for the other countries, it is working towards making its art market data accessible to the entire planet. Apart from anything else, this mission involves the translation and documentation of the spellings of proper names that change from one language to another. To make this possible, Artprice needed a unique and exceptional authorization to cross the frontier of the Chinese Internet. The resulting fluidity of information has generated an online commerce of artworks, via WeChat1, across national borders, a platform that the Chinese are familiar with, especially for luxury purchases.

In 2017 Artprice had already anticipated a massive proliferation in the flow of information and a massive expansion of the art market’s clientele by making its data available to the smartphones (much of it free of charge) of anyone interested in art. This evolution is at the very core of a strategy designed to turn the art market into a demand driven online market, without the intervention of intermediaries.

However for a real revolution to take place, raw information is not enough; it also requires analytical tools. This is the need to which Artprice has crucially responded, creating numerous equally accessible indices that allow an understanding of the art market from a variety of different angles.

Understanding the art market is no longer reserved for specialists and experts. In short, it has been demystified.

The last hurdle to jump is that of the existing monopoly on visibility: to do this Ehrmann and his teams have decided to feed global data from the art market to all journalists and media around the world. This new project was initiated by a deal signed on 26 December 2018 between Artprice and the 120-year press mogul Cision to create the world’s first press agency dedicated to the art market: Art Press Agency. The ‘Access-to-Information’ revolution that this deal represents is shaking the foundations of the existing system: the various different art markets, be they supply or demand, global or local, are now all in competition.

FROM A HEGEMONIC ‘GLOBAL’ ART MARKET TO A ‘PLURALISTIC’ ART MARKET COMPETING ON EQUAL TERMS

And so… Artprice’s initiatives, along with Artron and Cision, are founded on the perception and acknowledgement of the ‘real’ global market, one that it is hidden behind today’s highly visible ‘global-financial’ market. Indeed, the Chinese, who currently spend the most on art, make no discrimination between the various artistic currents. They consume ultra high-end art, well above the million-dollar threshold, including conceptual art validated in New York, as well as art created by artists with purely aesthetic concerns in the long tradition of art history (particularly their own). Indeed, the Chinese market is today far more geopolitically representative of the true diversity of art in the world than the New York marketplace.

The ‘global-financial’ art that has established itself as the reference since the collapse of the Soviet Union has lost its power to provoke and surprise, despite its astronomical prices. The idea of ‘global culture and art’ as a historical fatality has been questioned by many countries for a decade. Global Kitsch art now looks like the last metamorphosis of a 20th century utopia that imagined the art of the future as being homogeneous and the same for everyone on the whole planet.

This utopic vision, which appears to have emerged alongside the proclamation of ‘socialist, international and communist realist art’, nowadays appears to be confronted with the latest incarnation of ‘global, international and financial conceptual art’… two sides of the same coin that reduces the world to an economic materialism supposed to explain everything.

(1) Artprice is one of the only Western companies to own a WeChat site (WeChat is reserved for companies operating under Chinese law) that reaches more than 1.8 billion Chinese Internet users worldwide.

See article (French only) on contrepoints.org: https://www.contrepoints.org/2019/01/10/334255-__trashed-5

Try our services (free demo): https://www.artprice.com/artist/23640/baishi-qi

Subscribe to our services: https://www.artprice.com/subscription

About Artprice:

Artprice is listed on the Eurolist by Euronext Paris, SRD long only and Euroclear: 7478 – Bloomberg: PRC – Reuters: ARTF.

Founded by thierry Ehrmann (see Who’s who certified Biography ) (c) https://imgpublic.artprice.com/img/wp/sites/11/2018/10/bio-2019-whos-who-thierry-ehrmann.pdf ).

Dicover Artprice in video: https://www.artprice.com/video

Artprice is the global leader in art price and art index databanks. It has over 30 million indices and auction results covering more than 700,000 artists. Artprice Images® gives unlimited access to the largest Art Market resource in the world: a library of 126 million images or prints of artworks from the year 1700 to the present day, along with comments by Artprice’s art historians.

Artprice permanently enriches its databanks with information from 6,300 auctioneers and it publishes a constant flow of art market trends for the world’s principal news agencies and approximately 7,200 international press publications. For its 4,500,000 members, Artprice gives access to the world’s leading Standardised Marketplace for buying and selling art. Artprice is preparing its blockchain for the Art Market. It is BPI-labelled (scientific national French label) Artprice’s Global Art Market Annual Report for 2017 published last March 2018: https://www.artprice.com/artprice-reports/the-art-market-in-2017

Artprice is associated with Artron Group the Chinese leader in the Art Market, its solid institutional partner.

About the Artron Group:

“Artron Art Group (Artron), a comprehensive cultural industrial group founded in 1993 by Wan jie, is committed to inheriting, enhancing and spreading art value. Based on abundant art data, Artron provides art industry and art fans with professional service and experience of quality products by integrated application of IT, advanced digital science and innovative crafts and materials. Having produced more than 60,000 books and auction catalogues, Artron is the world’s largest art book printer with a total print volume of 300 million a year. It has more than 3 million professional members in the arts sector and an average of 15 million daily visits, making it the world’s leading art website.”

Artron’s Web: www.Artron.net

Artprice’s Contemporary Art Market Annual Report for 2017 – free access at: https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2017

Artprice’s press releases:

http://serveur.serveur.com/Press_Release/pressreleaseen.htm

https://twitter.com/artpricedotcom

Artmarket News:

https://twitter.com/artpricedotcom & https://twitter.com/artmarketdotcom

https://www.facebook.com/artpricedotcom 3.4 million subscribers

http://artmarketinsight.wordpress.com/

Discover the Alchemy and the universe of Artprice http://web.artprice.com/video, which headquarters are the famous Museum of Contemporary Art, the Abode of Chaos:

The Contemporary Art Museum The Abode of Chaos

https://www.facebook.com/la.demeure.du.chaos.theabodeofchaos999 3.4 million subscribers

Contact: ir@artprice.com

Visibilité des marchés de l’Art : l’alliance ARTPRICE-ARTRON-CISION via CONTREPOINTS.ORG

Visibilité des marchés de l’Art : l’alliance ARTPRICE-ARTRON–CISION via CONTREPOINTS.ORG

Histoire de l’obsolescence d’une hégémonie et naissance d’une concurrence.

Par Aude de Kerros.

En ce début de 2019 le marché international de l’art connaît un événement susceptible de modifier en profondeur le système en place. Il s’agit d’une alliance commerciale et stratégique inattendue. Elle a été passée entre trois entreprises fondées sur la création et mise à profit de banques de données. Deux sont spécialisées dans le domaine de l’art, ayant aussi une capacité de vente en ligne — et une troisième répertorie les données de la presse internationale et met en relation les besoins de toute communication avec les médias qui correspondent.

Cette alliance intervient au terme d’une décennie ayant connu une révolution technologique de la communication et un changement des rapports de force géopolitiques. Une rivalité est apparue entre les tenants d’un très haut marché de l’Art mainstream, visible mondialement, seul labélisé « contemporain- international » — et des marchés qualifiés de « locaux », vendant un art dit « identitaire – non novateur ». C’est dans ce contexte que survient un partenariat, inédit entre Artprice – Artron – Cision.

– Artprice, à l’origine de cette aventure, est une entreprise privée française, menée par un personnage hors système et hors normes dont le principal mobile est sa liberté. Thierry Ehrmann est le créateur de la banque de données la plus complète du marché de l’Art mondial. Elle est exhaustive, incluant à la fois le global art financier et les arts non conformes… ce que l’État français n’a pas fait, à son échelle nationale, puisque son travail d’archivage ne retient que les « officiels conceptuels ».

– Artron est une institution de l’État chinois qui depuis 1996 a pour but de promouvoir art et création en Chine, en créant tous les outils nécessaires à l’existence d’un marché non existant sous le régime communiste, dont une banque de données exhaustive, n’écartant aucun courant de l’Art chinois.

– Cision est un Argus de la presse, dont le quartier général est à Chicago, fournissant aux stratèges de l’influence et la communication un service de mise en relation adaptée, avec les médias du monde entier.

UN CHASSEUR D’ENTENTES ET DE MONOPOLES

Thierry Ehrmann est un Robin des bois qui n’aime pas les monopoles et les intermédiaires et leur fait la chasse. Il se nourrit de la bête et libère ainsi « vertueusement » le monde de l’Art de ses prédateurs. En déchiffrant les données de sa banque, il a constaté que le haut marché de l’art global, référencé à New-York, seul visible mondialement, est un marché de l’offre, hors sol, sans concurrence. Il a perçu également que le marché réel, qui est un marché de la demande, est infiniment plus vaste, mais sous-développé pour cause d’invisibilité.

À l’inverse, le marché hégémonique vit d’un réseau international, fortement interconnecté, partageant des intérêts communs, tenant foires, ventes aux enchères, expositions dans musées et galeries internationales. Son modèle économique associe une fonction de marché financier, sécurisé par des collectionneurs opérant en vase clos et un marché de masse commercialisant des objets dérivés arty, sériels, industriels, faisant de l’œuvre à 50 millions de dollars le produit d’appel décliné à tous les prix et formats, de la réplique pour galerie au porte-clefs et t-shirts.

Ce marché doit sa légitimité à sa rentabilité et à ses utilités : plateforme mondaine et d’affaires, occasion d’animation urbaine, touristique et muséale. Ainsi, l’Art Global Financier gagne sa vie en bénéficiant par ailleurs des dons, qui ont l’avantage d’être défiscalisés, de mécènes, sociétés, institutions, et des subventions de certains États. La CIA, qui y joua sa partie, est pour l’heure, missionnée ailleurs.

Pour Thierry Ehrmann, c’est un consortium conjugué d’ententes, à sa mesure.

Les données de sa banque lui donnent la primeur de l’information et les moyens d’analyse propres à lui inspirer une stratégie. Ainsi, il est le premier à constater que la Chine est passée en tête du marché de l’art dès 2009, devant l’Amérique. Le fait est peu commenté, les médias font comme si cela n’entraîne aucune conséquence. Thierry Ehrmann comprend qu’il est impensable d’avoir une banque de données à prétention planétaire sans y introduire les données chinoises, difficiles d’accès en raison de l’obstacle de la langue et du mur que constitue « Intranet » isolant la Chine de toute communication numérique avec le reste du monde. C’est ce qui motive fortement son rapprochement avec l’Agence chinoise Artron et son alliance officielle avec elle en septembre 2018.

Comme Artprice l’a déjà fait pour tous les autres pays, il s’emploie à rendre ses données accessibles au monde entier, en traduisant et en documentant notamment toutes les orthographes des noms propres qui changent d’une langue à l’autre. Pour que ce soit possible, il a fallu bénéficier d’une autorisation unique et exceptionnelle, accordée à Artprice, de franchir le mur de l’Intranet chinois. La fluidité de l’information ainsi obtenue a pour conséquence la naissance d’un commerce en ligne d’œuvres d’art, grâce à WeChat (1), par-dessus les frontières, ce dont les Chinois sont familiers notamment pour les achats de luxe.

Artprice, en 2017, avait déjà anticipé cette démultiplication de la circulation de l’information et l’élargissement de la clientèle du marché de l’art, en rendant accessibles ses données, pour partie gratuitement, à tous les amateurs sur leur smartphone, ce qui facilite un marché de la demande, en ligne, sans le filtre des intermédiaires.

Mais pour une véritable révolution, l’information brute ne suffit pas, il faut aussi des instruments d’analyse. C’est la nécessité à la quelle Artprice répond, créant plusieurs indices, également accessibles, pour décrire ce marché sous ses divers angles.

Il n’est plus nécessaire d’être expert pour déchiffrer le marché et donc le démystifier.

Reste un dernier obstacle à surmonter pour casser le monopole actuel de la visibilité : mettre en rapport les données vraiment mondiales du marché de l’art et la totalité des journalistes et médias du monde entier. C’est chose faite le 26 décembre 2018, par l’accord signé entre Artprice et Cision pour créer la première agence de presse mondiale dédiée au Marché de l’Art : Art Press Agency. Cette Révolution de l’accessibilité à l’information bouleverse le contexte : les divers marchés de l’art, qu’ils soient de l’offre où de la demande, du global ou du local, sont désormais en concurrence.

DE L’ART GLOBAL HÉGÉMONIQUE AUX ARTS PLURIELS EN CONCURRENCE

Ainsi une autre réalité du marché planétaire apparaît, et l’on constate qu’il ne ressemble pas au marché global-financier, seul visible actuellement. En effet, les Chinois, qui aujourd’hui achètent le plus, ne font aucune discrimination entre les divers courants artistiques. Ils ont porté sur le très haut marché, bien au-dessus du million de dollars, à la fois l’art conceptuel validé à New York et les artistes qu’ils aiment pratiquant un art esthétique dans la suite de l’art. La Chine se trouve être de fait plus représentative géopolitiquement de la vraie diversité de l’art dans le monde que la place de New York.

L’art global-financier qui s’est installé comme référence après l’effondrement soviétique a perdu de son pouvoir provocateur et stupéfiant, malgré ses cotes oniriques. L’idée de « culture et d’art global » comme fatalité historique est remise en question par beaucoup de pays depuis une décennie. L’art global kitsch apparaît soudain comme le dernier avatar d’une vieille utopie du XXe siècle qui voyait l’art du futur comme étant homogène et unique sur toute la planète.

Cette utopie, née avec la proclamation de « l’Art réaliste socialiste, international et communiste », meurt avec le « l’art conceptuel global, international et financier », deux faces de la même pièce de monnaie qui réduit le monde à un matérialisme économique, sensé tout expliquer.

(1). Artprice est une des seules sociétés occidentales à posséder un site WeChat réservé aux sociétés de droit chinois qui touche plus de 1,8 milliard d’internautes chinois dans le monde.

Article sur contrepoints.org : https://www.contrepoints.org/2019/01/10/334255-__trashed-5

En savoir plus sur nos services avec l’artiste gratuit : https://fr.artprice.com/artiste/23640/baishi-qi

Nos services : https://fr.artprice.com/subscription

Copyright ©2019 thierry Ehrmann – www.artprice.com

Au sujet d’Artron :

Artprice couvre le monde entier et notamment la Chine avec son fidèle partenaire institutionnel Artron Art Group (Artron) fondé en 1993 et présidé par son Fondateur Mr Wan Jie qui est le plus grand imprimeur de livres d’art au monde, avec plus de 60 000 livres et catalogues de vente aux enchères et un volume de publication total de 300 millions par an. Artron.net est la marque la plus respectée du monde de l’art chinois. Artron.net compte plus de 3 millions de membres professionnels dans le secteur des arts et 15 millions de visites quotidiennes en moyenne, ce qui en fait le premier site Web d’art mondial.

A propos d’Artprice :

Artprice est cotée sur Eurolist by Euronext Paris, SRD long only et Euroclear : 7478 – Bloomberg : PRC – Reuters : ARTF.

Découvrir Artprice en vidéo : https://fr.artprice.com/video

Artprice fut fondée en 1997 par thierry Ehrmann qui est son PDG. Artprice est auto-contrôlée par le Groupe Serveur créé en 1987. Voir biographie certifiée de Who’s who © :

https://imgpublic.artprice.com/img/wp/sites/11/2018/10/bio-2019-whos-who-thierry-ehrmann.pdf

Artprice est le Leader mondial des banques de données sur la cotation et les indices de l’Art avec plus de 30 millions d’indices et résultats de ventes couvrant plus de 700 000 Artistes. Artprice Images® permet un accès illimité au plus grand fonds du Marché de l’Art au monde, bibliothèque constituée de 126 millions d’images ou gravures d’oeuvres d’Art de 1700 à nos jours commentées par ses historiens.

Artprice enrichit en permanence ses banques de données en provenance de 6300 Maisons de Ventes et publie en continu les tendances du Marché de l’Art pour les principales agences et 7200 titres de presse dans le monde. Artprice met à la disposition de ses 4,5 millions de membres (members log in), les annonces déposées par ses Membres, qui constituent désormais la première Place de Marché Normalisée® mondiale pour acheter et vendre des oeuvres d’Art à prix fixe ou aux enchères (enchères réglementées par les alinéas 2 et 3 de l’article L 321.3 du Code du Commerce).

Artprice, labellisée par le BPI pour la deuxième fois en novembre 2018, développe son projet de Blockchain sur le Marché de l’Art.

Bilan S1 2018 Mondial du Marché de l’Art, par Artprice en ligne sur :

https://fr.artprice.com/artprice-reports/bilan-du-marche-de-lart-s1-2018-par-artprice-com

Le Rapport Annuel Artprice du Marché de l’Art mondial 2017 publié en mars 2018 :

https://fr.artprice.com/artprice-reports/le-marche-de-lart-en-2017

Le Rapport du Marché de l’Art Contemporain 2018 d’Artprice :

https://fr.artprice.com/artprice-reports/le-marche-de-lart-contemporain-2018

Sommaire des communiqués d’Artprice :

http://serveur.serveur.com/press_release/pressreleasefr.htm

https://twitter.com/artpricedotcom

Suivre en temps réel toute l’actualité du Marché de l’Art avec Artprice sur Facebook, Google+ Twitter :

https://www.facebook.com/artpricedotcom 3,4 millions d’abonnés

https://twitter.com/artpricedotcom & https://twitter.com/artmarketdotcom

https://plus.google.com/+Artpricedotcom/posts

http://artmarketinsight.wordpress.com/

Découvrir l’alchimie et l’univers d’Artprice http://web.artprice.com/video dont le siège social est le célèbre Musée d’art contemporain Abode of Chaos dixit The New York Times / La Demeure du Chaos: https://issuu.com/demeureduchaos/docs/demeureduchaos-abodeofchaos-opus-ix-1999-2013

Musée d’Art Contemporain siège social d’Artprice :

https://www.facebook.com/la.demeure.du.chaos.theabodeofchaos999

(3,5 millions d’abonnés)

Contact ir@artprice.com

Vous devez être connecté pour poster un commentaire.